The holiday shopping season brings a surge in online transactions, making it a prime target for cybercriminals. Ensuring secure online payment processes is critical to safeguarding both consumers and businesses. Cyber threats, including fraudulent transactions and data breaches, continue to evolve, requiring robust measures to mitigate risks. Companies must adopt advanced technologies such as encryption and tokenization to protect sensitive information. Proactive monitoring and threat detection further enhance the security landscape, ensuring customers a seamless and safe shopping experience. Consumers play a significant role in securing their online payment activities. Adopting secure browsing practices, avoiding suspicious links, and using trusted payment methods add protection against potential threats. Multi-factor authentication (MFA) is another essential tool that enhances security by requiring additional verification steps. These measures create a comprehensive defense against cyber risks during the busy holiday season.

Fraudulent Transaction Detection: Staying One Step Ahead

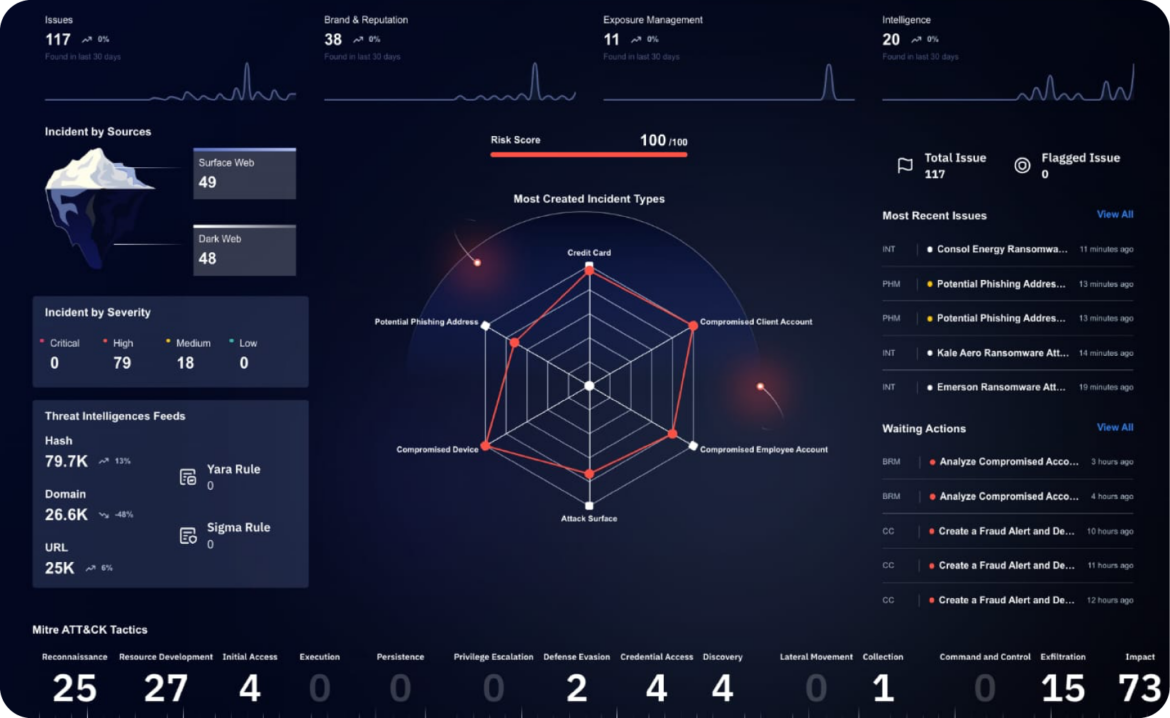

Real-time detection of fraudulent transactions is a pivotal aspect of contemporary cybersecurity efforts aimed at countering the growing sophistication of cybercriminal tactics. Malicious actors leverage advanced techniques, including synthetic identity fraud and automated bots, to exploit weaknesses in payment systems. Employing cutting-edge fraudulent transaction detection tools powered by artificial intelligence (AI) and machine learning enables systems to analyze transactional behaviors. These tools identify anomalies such as inconsistencies in geolocation, device fingerprint mismatches, or irregular purchase patterns, which may signal potential fraud.

Complementing technology with consumer education further fortifies defenses. Encouraging practices like regular account monitoring, immediate reporting of unauthorized charges, and vigilance against unsolicited requests for sensitive information empower users to act as an additional layer of defense. By integrating comprehensive fraud detection solutions with proactive awareness initiatives, businesses can significantly reduce the likelihood of financial loss and build enduring trust with their customers.

Achieving PCI DSS Compliance for Secure Transactions

Achieving PCI DSS compliance requires implementing an array of safeguards, including robust encryption protocols to secure data during transit and at rest, restricting access to sensitive information, and employing tokenization to substitute sensitive data with unique identifiers. These measures collectively minimize the risk of data breaches.

Employee training plays a critical role in sustaining compliance efforts. Equipping staff with knowledge about recognizing potential threats, adhering to secure payment practices, and following compliance protocols ensures a culture of accountability. Regular assessments and penetration testing can identify and mitigate emerging risks. By staying vigilant and aligned with PCI DSS requirements, businesses secure transactions and elevate their reputation as trustworthy entities, fostering confidence among customers and partners.

Using AI to Detect Transaction Anomalies

While effective in earlier cyber landscapes, traditional fraud detection methods struggle against the volume and complexity of modern digital threats. AI-driven transaction anomaly detection systems excel at processing vast datasets in real time, recognizing subtle deviations that might escape conventional scrutiny. By analyzing parameters such as transaction frequency, purchase history, and location consistency, these systems swiftly flag suspicious activities for review.

In addition to their detection capabilities, AI solutions significantly reduce false positives, which have historically burdened security teams with unnecessary alerts. This refined accuracy allows teams to concentrate on legitimate threats, optimizing resource allocation and response times. Integrating AI into cybersecurity frameworks provides businesses with a proactive approach, effectively shielding them from emerging threats and ensuring a secure, seamless transaction experience for their clientele.

Preventing Data Breaches in Online Payment Systems

Data breaches represent a persistent and costly threat to online payment systems, jeopardizing customer trust and exposing businesses to severe financial and reputational damage. Effective data breach prevention begins with implementing end-to-end encryption to secure information transmission, ensuring that sensitive data remains inaccessible to unauthorized entities. Additionally, adopting tokenization methods replaces sensitive data with nonsensitive equivalents, mitigating the impact of potential breaches.

Regularly updating software and hardware systems is equally crucial, as attackers often exploit vulnerabilities in outdated infrastructure. Incorporating continuous monitoring systems to detect unusual access patterns or unauthorized activity helps businesses preempt breaches. Finally, having an actionable incident response plan ensures swift containment and resolution of breaches, minimizing disruption and restoring operational normalcy. These layered approaches reinforce the security of payment systems, protecting both the businesses and the consumers they serve.

Enhancing Email Security to Protect Payment Data

Email communication remains a critical attack vector for cybercriminals aiming to compromise payment data. Phishing campaigns and malware-laden emails are created to deceive recipients into divulging sensitive data or unwittingly installing malicious software. Leveraging AI in email security provides an advanced line of defense against such threats. AI-powered filters analyze and identify suspicious elements within email content, attachments, and links, preventing them from reaching user inboxes.

Employee and customer education further bolsters email security. Individuals can more effectively recognize and avoid potential threats by fostering an understanding of common phishing tactics, such as spoofed sender addresses and urgent requests for personal information. Encouraging encryption for sensitive communications and secure login methods, including multi-factor authentication, adds an extra layer of protection. These comprehensive measures ensure that payment data remains safeguarded against email-based threats, maintaining the integrity and trustworthiness of online transactions.